Trump’s challenge to Southeast Asian development

Brexit and the election of Donald Trump have shocked political and economic elites throughout Asia. For the last decades, the Asian development largely depended on open world markets and the presence of a US security umbrella. The political uprising against globalization under populist leaders now threatens to put a quick end to both. The shock sits particularly deep as potential policy change could not be more radical. Only during the Obama administration have economic and security partnerships with Southeast Asia been strengthened. A first harbinger of what is yet to come is the suspension, if not de facto cancellation, of the Trans-Pacific Partnership Agreement (TPP). Without a majority in the US Congress the TPP, at least in its current form, is dead. And that is rather likely.

While Trump’s campaign was marked by erratic statements across policy-domains, his course on trade policy has been consistently protectionist. Given how strongly this position resonates with his political platform, especially the blue-collar workers that lost their job due to globalization and technological innovation, a significant deviation from this course seems close to political suicide. Well aware of this, the Asian signatory parties immediately started what is probably best understood as a mix of panic and public diplomacy. Malaysia renewed its support for the agreement, Singapore and Japan rush for ratification, and Vietnam publicly announced to pull the plug on TPP.

Like its European counterpart, the Transatlantic Trade and Investment Partnership (TTIP), the TPP has drawn fierce criticism from an unusually broad coalition of populists, protectionists, labor and environmental groups, SMEs, orthodox free trade admirers across the political spectrum. The secrecy surrounding the negotiations not only amplified existing fears of hyperglobalization and corporate capture, it also put a spotlight on the lack of democratic participation and accountability in shaping the global politico-economic order of the future. Against this backdrop, one feels tempted to ask “Should there finally be something good about Trump’s election?” Unfortunately, the answer is probably not. Less because the TPP is a great agreement – in many ways it is not – but because the alternatives are not necessarily any more appealing.

In combination with its geo-political and -economic embedding, the mere complexity of the TPP make even the savvy observer wonder by which standards to judge the agreement. Going far beyond the standard lowering of tariff barriers, the “removal” of behind-the-border barriers to trade makes up the core of TPP. It includes regulations for issues as diverse as investment safeguards, intellectual property rights, customs procedures, state-owned enterprises, labor and environmental standards, and dispute settlement. US trade policymakers behind the blueprint hail it as the “platinum standard” in 21st century trade. Trump calls it “a continuing rape of“ America and included its abolishment in his to-do-list for the first 100 days in office (The Guardian 2016).

While both statements seem grossly overstated, it is clear that some of the provisions in the TPP would come with significant adjustment costs to some of its members, especially the lesser developed countries. To understand why countries such as Malaysia and Vietnam signed the agreement in the first place, and others such as Indonesia and the Philippines (before its “divorce” from the US) showed interest in joining the TPP, requires to take a step back and look at the broader geo-economic and -strategic environment in the Asia-Pacific developed over the last decade.

The geo-economics of Southeast Asian trade

Ever since the 2001 preferential trade agreement (PTA) between China and ASEAN, trade agreements have played a significant role in foreign-policy signaling in the region. In the subsequent period a “political domino” has led to a mushrooming of trade agreements in the region, resulting in the infamous ‘noodle-bowl’ of PTAs (Ravenhill 2010; Baldwin 2008). TPP and its Chinese counterpart, the Regional Comprehensive Economic Partnership (RCEP) were the latest acts in this play (the latter includes India, South Korea and all ASEAN members but not the US). The TPP as a main pillar of the US “pivot” to Asia is closely related to US security interests in the region. In the words of US Secretary of Defense Ashton Carter the TPP was “as important […] another aircraft carrier” in the Pacific (Parameswaran 2015). The statement could hardly be clearer about how closely economic and security preponderance are related in the eyes of US policymakers.

In the meantime the volume of China’s trade with Southeast Asia increased tenfold between 2000 and 2015, making it the largest trading partner of virtually all economies in the region. For the countries of Southeast Asia this would be less of a problem, if not almost two-thirds of its volume would show in their import balance. As a result, the IMF projects current account balances (roughly the balance of trade and investment flows combined) to reach near zero, if not turn negative before 2020 (IMF 2016). Given how sophisticated Chinese exports are at given income levels (Rodrik 2006), Southeast Asian countries have no illusions that they will be able to compete with Chinese exports on a large scale any time soon.

A closer look at TPP and its alternatives

A major incentive for its Southeast Asian member to sign the deal was TPP’s promises to develop new export markets, discriminate against competitors in existing markets, and attract additional foreign direct investment. The TPP thereby follows a different, complementary (or contrary) strategy to the Chinese approach of supplementing trade in goods with the respective “hardware”, e.g. through the Asian Infrastructure Investment Bank (see AIIB article). TPP’s focus, instead, is on shaping the “software” that governs economic relations, i.e. the rules of trade and investment in global supply chains. Growth estimates for the TPP are to be seen with caution as tariff liberalization only accounts for a minor share of the expected growth impact. Behind-the-border barriers, however, are difficult to quantify, not only because of their breadth and depth but also because their effect largely depends on successful domestic implementation.

Chances therefore are that estimates are overly optimistic in the first place. According to (free trade-friendly) Peterson Institute of International Economics and the World Bank, overall GDP gains from the TPP would be particularly high for Vietnam (8-10%) and Malaysia (~8%) for the period until 2030 (Petri and Plummer 2016; World Bank 2016). As some of these gains would be realized by diverting trade, other countries with a strong comparative advantage in sectors such as apparel, textiles and footwear (e.g. China, Bangladesh, Laos, Cambodia and Nepal) or light industrial goods (e.g. Thailand, Indonesia, and China) would most likely appreciate the death of TPP.

Unfortunately, Trump’s campaign threat to impose punitive taxes, especially on China but possibly also other countries, at least has the chance to be even more damaging. Whether they will become a reality at this point is uncertain. From a mere economic point of view, they seem rather unlikely as industry structures in the US and Asia are largely complementary by now so that the promise for repatriation of jobs could only be realized at significant cost. For example, although nearly 40% and 17% of apparel products sold in the US are imported from China and the ASEAN countries respectively, the US industry only employs 90,000 workers and accounts for 10% of total garment consumption (OTEXA 2016). A significant repatriation of jobs in the sector would not only require higher tariffs but also come with rising consumer prices.

A second aspect is illustrated by the politically more contentious case of the US steel industry where about 130,000-150,000 workers are employed. The case demonstrates vividly that the issue is not simply solved by applying punitive tariffs. After anti-dumping tariffs were imposed on China earlier this year, steel was allegedly channeled through Vietnam where lower tariffs apply (Miller 2016). Without stricter regulations on rules-of-origin, something TPP would indeed take a rather liberal stance on, these measures seem rather ineffective in the first place and would thus require the implementation of punitive tariffs on a wide scale. Although the economic rationale for higher tariffs is limited, things might look different from the point of view of political symbolism and Trump clearly demonstrated his willingness to appeal to the grievances of his political platform.

Labor rights: a tool for arbitrary protectionism?

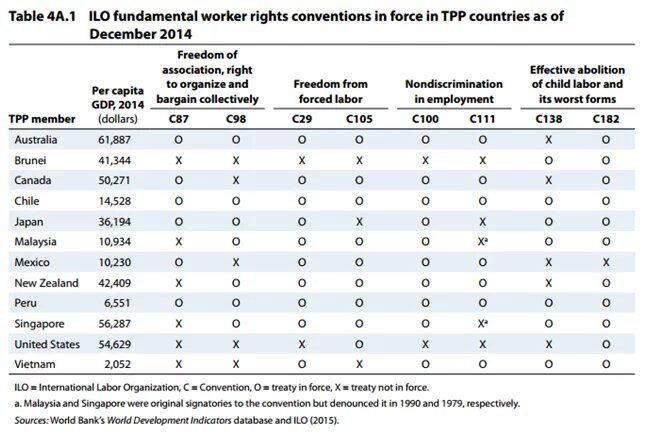

On the issue of labor rights, TPP would have the potential to make limited positive change. The agreement would require its members to enforce core labor standards of the International Labor Organization’s (ILO) Declaration on Fundamental Principles and Rights at Work, an area where Brunei, Malaysia, and Vietnam show considerable gaps (see table below).

In order to comply with the standards comprehensive bilateral Consistency Plans for capacity building and policy reform as well as monitoring mechanisms were developed (for details see Cimino-Issacs 2016, 49f).

Most importantly, the provisions would be subject to dispute settlement and breaches could potentially lead to trade sanctions.

On the negative side, TPP fails to include the possibility for societal actors to appeal to the dispute settlement mechanism. The role for societal surveillance in domestic enforcement is therefore significantly weakened. The feature would have been much welcome in order to the raise labor rights issues to a comparable level as investment guarantees (AFL-CIO 2016). This is especially relevant as despite the recent upward trend the record of accepted labor petitions is limited compared to the number of investment litigations in the US.

During the Obama administration petitions to suspend preferential tariffs were initiated against Thailand and the Philippines for breaches of worker rights as well as Indonesia for copyright infringements. Under Trump these measures may indeed become the weapon of choice to impose additional tariffs on Southeast countries, especially given the broad societal consensus against theses issues. The problem here obviously lays not with defending worker rights in the first place. The risk instead is that a weak but rule-based TPP approach gives way to a more arbitrary approach with substantial political fallout for US-Southeast Asian relations. Very similar logics apply to the contentious issue of state-owned enterprises, intellectual property rights, and currency manipulations for which TPP includes provisions.

Environmental Protection: How Low Can You Go?

TPP provisions on the environment are indeed rather weak. On the upside, TPP would make environmental issues such as illegal, unreported and unregulated fishing, fish stock damaging subsidies, and maritime conservation subject to dispute settlement. Particularly positive is that TPP opened the door to pursue breaches of other multilateral environmental agreements as part of its dispute settlement provisions. Unfortunately, this only concerns marine pollution (MARPOL), overexploitation of wildlife (CITES), and substances that deplete the ozone layer as regulated in the Montreal Protocol.

On the downside, the omission to not even mention climate change is representative of the limited breadth of the chapter. The limited coverage is a delicate issue as those issues not explicitly regulated in the TPP chapters could potentially be subject to litigation. The weakness of the environmental chapter therefore needs to be understood in relation to the strength of the investment safeguards, in particular the investor-state-dispute settlement (ISDS) clause discussed below. Whether the protection of the environment will a priority of the Trump administration is highly doubtable. The campaign rhetoric on climate issues does not promise positive change in this policy-domain, quite the contrary. Thus, future agreements are likely be even weaker on protection of the environment.

An end to TPP: a drop in the ocean of investor-state litigation?

The indeed most contentious passages of the TPP concern the included investment safeguards. Regulatory uncertainty and poor legal enforcements are major impediments to investments in the region. The potential for additional foreign direct investment is huge. US investment in Vietnam amounts to a low 1.5% of total inflows. ISDS clauses aim to provide respective safeguards by giving companies a tool to sue governments where their investments are allegedly threatened. In practice however ISDS clauses seem to have little positive effect on the volume of foreign direct investment (Rose-Ackerman and Tobin 2005). In any case, the greater concern with ISDS is its potential to induce “regulatory chill”. In expectation of being sued by companies, governments may delay, water down or cancel progressive social, labor, public health or environmental legislation.

Measuring this effect is borne with difficulties. More often than not these issues remain behind closed doors. What seems to emerge as a pattern, though, is that litigations may be useful where progressive legislation is already in place but enforcement is poor. The case of a Canadian investor that sued the government of Barbados for not enforcing its environmental laws is a case in point of the first pattern. In contrast, where progressive legislation is yet to come, their effect may indeed be negative. Unfortunately, the second pattern is more prominent. Around one-third of ISDS cases involve companies in the natural resource sector where labor and environmental standards are at its lowest. Indonesia for example rolled back progressive legislation to raise environmental standards in its resource industry in order to avoid litigation (Transnational Institute 2014)

As a consequence, in early 2014, Indonesia announced to terminate 67 of its bilateral investment treaties. Whether this will ever happen is however questionable. Not only did President Jokowi announce Indonesia’s interest to join TPP, but like virtually all East Asian countries, it is part of the China-initiated RCEP which has its own ISDS clause. It remains to be seen whether India’s proposal to amend ISDS clauses so that all domestic remedies need to be pursued before international arbitration becomes possible. While this seems sensible in several ways, it makes the mechanism toothless where the judiciary is plagued by corruption. For the time being, ISDS might therefore remain at catch 22 between corrupt domestic courts and opaque arbitration panels. Most importantly, an end to TPP seems little more than a drop in the ocean. Asian countries have signed over 1100 international investments agreements, most of which include the investor-state dispute settlement (ISDS) mechanism (bilaterals.org 2016).

A rough patch ahead for Southeast Asia?

The arguments made here should not be misunderstood as an endorsement of TPP. The agreement shows severe shortcomings on a range of issues, including those not covered here such as state-owned enterprises, currency manipulations, digital services, intellectual property rights, and public procurement. However, political change in the US made it necessary to look closer at possible alternative policy scenarios and, as it seems, they are not necessarily more appealing. Although little is known about Trump’s actual Asia strategy, the noisy campaign rhetoric promises little positive change for the countries of Southeast Asia. Increased US protectionism, whatever shape it would take, certainly poses a threat to economic and, subsequently, political stability in an already fragile Southeast Asia. US disengagement from the region would almost certainly draw, if not force, countries closer into the Chinese orbit. Whether an increased role for China would result in stronger labor rights, more effective protection of the environment, and an increase in high-quality investments in the region, is questionable at best. Southeast Asia, it seems, is heading for a rough patch, with or without TPP.

References

AFL-CIO. 2016. “A Gold Standard for Workers? The State of Labor Rights in Trans-Pacific Partnership Countries.” Washingtion D.C.

Baldwin, Richard E. 2008. “Managing the Noodle Bowl: The Fragility of East Asian Regionalism.” The Singapore Economic Review 53 (03): 449–78.

bilaterals.org. 2016. “Asia | ISDS Platform.” Accessed November 20. http://isds.bilaterals.org/?-asia-264-&debut_sum=10#pagination_sum.

Cimino-Issacs. 2016. “Labor Standards in the TPP.” In Assessing the Trans-Pacific Partnership. Volume 2: Innovations in Trading Rules, edited by Jeffrey J. Schott and Cathleen Cimino-Issacs, 41–65. Washingtion, D.C.: Peterson Institute for International Economics.

IMF. 2016. “World Economic Outlook Database.” October. https://www.imf.org/external/pubs/ft/weo/2016/02/weodata/index.aspx.

Miller, John W. 2016. “U.S. to Launch New Chinese Steel Probe.” Wall Street Journal, November 6, sec. Markets. http://www.wsj.com/articles/u-s-to-launch-new-chinese-steel-probe-14784….

The Guardian. 2016. “Trump: Trans-Pacific Partnership ‘Just a Continuing Rape of Our Country’ – as It Happened,” June 29, sec. US news. https://www.theguardian.com/us-news/live/2016/jun/28/us-election-campaign-2016-clinton-trump-sanders.

Parameswaran, Prashanth. 2015. “TPP as Important as Another Aircraft Carrier: US Defense Secretary.” The Diplomat, April 8. http://thediplomat.com/2015/04/tpp-as-important-as-another-aircraft-car….

Petri, Peter A., and Michael G. Plummer. 2016. “The Economic Effects of the Trans-Pacific Partnership: New Estimates.” Working Paper 16-2. Washingtion D.C.: Peterson Institute for International Economics. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2723413.

Ravenhill, John. 2010. “The ‘New East Asian Regionalism’: A Political Domino Effect.” Review of International Political Economy 17 (2): 178–208.

Rodrik, Dani. 2006. “What’s So Special about China’s Exports?” Working Paper 11947. National Bureau of Economic Research. http://www.nber.org/papers/w11947.

Rose-Ackerman, Susan, and Jennifer Tobin. 2005. “Foreign Direct Investment and the Business Environment in Developing Countries: The Impact of Bilateral Investment Treaties.” Yale Law & Economics Research Paper No. 293. Rochester, NY. https://papers.ssrn.com/abstract=557121.

Transnational Institute. 2014. “The Case of Newmont Mining vs Indonesia.” November 12. https://www.tni.org/en/briefing/netherlands-indonesia-bit-rolls-back-im….

World Bank. 2016. “Potential Macroeconomic Implications of the Trans-Pacific Partnership.” Global Economic Prosepct January 2016. Washingtion D.C.: World Bank. https://www.worldbank.org/content/dam/Worldbank/GEP/GEP2016a/Global-Eco….