Timor-Leste’s Infrastructure Fund was created to assist in the process of diversifying the economy, with strong investments so far in transport and power. But to facilitate further economic activities, shifts in government spending and investment into the productive sectors such as agriculture and tourism will lay the path to greater diversification.

Over the last decade, development in Timor-Leste has been guided by the Strategic Development Plan (SDP) 2011–2030, which aims to make Timor-Leste an upper middle-income country by 2030. SDP covers three key areas: social capital, infrastructure development, and economic development as the pillars to drive the country forward. To achieve development envisioned in the SDP, Timor-Leste has thus far relied on the money generated from its oil resources, particularly through the investment of the Petroleum Fund. The government’s Budget Book 1 report shows that a total revenue of USD $508.5 million was generated in 2020, of which 80% came from the oil revenues. This means that Timor-Leste generates little domestic revenues from the non-oil sectors, revealing its underdeveloped productive sectors and weak private actors, among others.

Based on the data derived from the government’s Transparency Portal, Timor-Leste has spent around USD $12.4 billion in the state budget from 2011 to 2020, spending that is made possible by oil money. Considering the USD $1.2 billion average annual state budget expenditure over the ten-year period (2011–2020), which is more than the returns of the Petroleum Fund investment and non-oil domestic revenues combined, Timor-Leste faces challenges of over-reliance on the oil money, excess withdrawal of the Petroleum Fund that threatens its sustainability, and the risk of economic shock post-oil due to underdeveloped key non-oil sectors.

Table 1: State Annual Budget Allocation and Execution, 2011–2020 (USD Million)

|

Year |

Allocation |

Execution |

|

2011 |

1.306.017,54 |

1.097.160,4 |

|

2012 |

1.806.449,83 |

1.197.610,1 |

|

2013 |

1.647.519,20 |

1.080.233,3 |

|

2014 |

1.500.000,25 |

1.339.249,7 |

|

2015 |

1.570.001,76 |

1.340.197,5 |

|

2016 |

1.952.558,67 |

1.629.934,8 |

|

2017 |

1.386.825,74 |

1.183.705,3 |

|

2018 |

1.277.371,99 |

1.158.159,1 |

|

2019 |

1.481.990,80 |

1.233.297,2 |

|

2020 |

1.497.042,62 |

1.135.573,8 |

|

Total |

15.425.778,39 |

12.395.121,1 |

The expenditure trend displayed in Table 1 reflects the size and absorptive capacity of Timor-Leste’s economy. This trend, however, puts Timor-Leste at a unique situation given that the economic activities are driven by the government’s expenditure. It is understood that an economy driven by oil money is not sustainable, and therefore the government emphasizes the priority to boost the productive sectors, particularly agriculture and tourism, to diversify the economy. To achieve a diversified economy, the government recognizes the need to invest in the key infrastructure to provide conditions for economic diversification activities to take place. This paper explores infrastructure investment in Timor-Leste and how it corresponds to the priority to diversify the economy through investment in the productive sectors.

Infrastructure investment in Timor-Leste: rationale and financing mechanism

In recent years, government policy has been one of front-loading expenditure, running high government budgets in the short run to finance capital spending for key infrastructure, which aim to encourage development of the private sector, increase diversification, and grow the overall economy. The spending for infrastructure falls under the capital development category of the state budget, and the data shows significant spending given that out of USD $12.4 billion total government expenditure from 2011–2020, USD $3.6 billion or 29% has been attributed for capital development (see Table 2).

Table 2: Total Budget vs Capital Development Budget Expenditure, 2011–2020 (USD Million)

|

Year |

Total Expenditure |

Capital Development Expenditure |

|

2011 |

1.097.160,4 |

554.975,87 |

|

2012 |

1.197.610,1 |

461.770,35 |

|

2013 |

1.080.233,3 |

311.592,40 |

|

2014 |

1.339.249,7 |

371.359,37 |

|

2015 |

1.340.197,5 |

272.773,14 |

|

2016 |

1.629.934,8 |

581.384,59 |

|

2017 |

1.183.705,3 |

245.745,72 |

|

2018 |

1.158.159,1 |

336.097,95 |

|

2019 |

1.233.297,2 |

286.835,78 |

|

2020 |

1.135.573,8 |

154.894,72 |

|

|

12.395.121,1 |

3.577.429,9 |

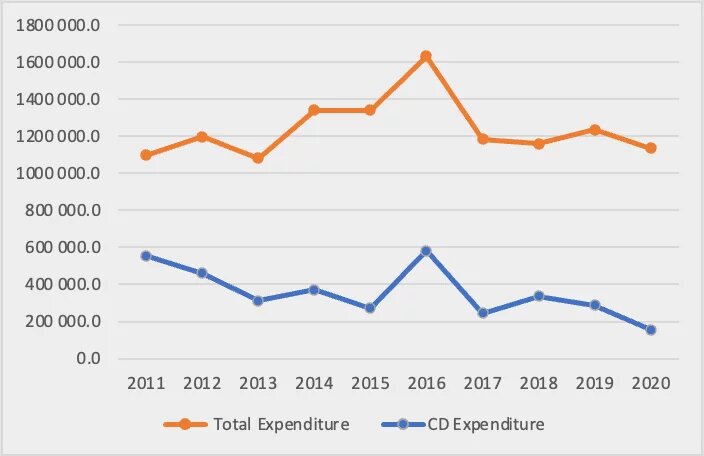

Figure 1: Trend of Total Expenditure & Capital Development Expenditure, 2011–2020

The expenditure trend shows a parallel pattern (see Figure 1) between total government spending with the spending on capital development, indicating the significance of the capital development expenditure on the government’s budget execution performance. This also means that the capital development expenditure plays an important role in stimulating economic activities in the country since infrastructure projects contribute to the creation of jobs and the flow of goods and services.

The government of Timor-Leste, guided by the SDP, established the Infrastructure Fund in 2011 as a special fund to finance large infrastructure projects. The establishment of this fund is in line with the government’s policy to provide strategic infrastructure to support and accelerate economic activities. The fund confirms the government’s intention to focus and intensify the investment in infrastructure, which is expected to become the catalyst for the process of diversifying the economy. With this fund, the government has a reliable financing tool to finance strategic infrastructure projects in the key sectors defined in the SDP.

Since its establishment, the Infrastructure Fund has become the main financing source for the mega projects, and it takes up the biggest share of the budget for capital development. Out of the USD $3.6 billion expenditure for capital development between 2011–2020, USD $3.1 billion (88%) is accounted to the Infrastructure Fund (see Table 3).

Table 3: Share of the Infrastructure Fund Budget, 2011–2020 (in USD Million)

Capital Development |

Budget |

Infrastructure Fund |

Budget |

|

|

Year |

Allocation |

Execution |

Allocation |

Execution |

|

2011 |

690.129,08 |

554.975,87 |

598.530,00 |

474.430,00 |

|

2012 |

998.042,95 |

461.770,35 |

875.130,00 |

376.090,00 |

|

2013 |

757.994,42 |

311.592,40 |

604.380,00 |

210.960,00 |

|

2014 |

456.367,61 |

371.359,37 |

368.550,00 |

310.700,00 |

|

2015 |

395.712,10 |

272.773,14 |

317.300,00 |

239.810,00 |

|

2016 |

833.068,00 |

581.384,59 |

784.470,00 |

549.640,00 |

|

2017 |

349.374,15 |

245.745,72 |

325.620,00 |

231.950,00 |

|

2018 |

393.953,44 |

336.097,95 |

368.010,00 |

331.230,00 |

|

2019 |

400.946,59 |

286.835,78 |

367.540,00 |

276.900,00 |

|

2020 |

210.781,31 |

154.894,72 |

184.930,00 |

138.740,00 |

|

|

5.486.369,6 |

3.577.429,9 |

4.794.460,0 |

3.140.450,0 |

Many large projects constructed in recent years have been financed through the Infrastructure Fund, including the airport in Suai, the Tibar Bay Port (co-financing with the private investment), electricity projects (including power plants and grids), and construction of national roads along the north coast (co-financing with loans).

While Timor-Leste’s government continues to allocate budgets for infrastructure projects, it also pursues other financing modalities including external borrowing (loans) and public-private partnerships (PPPs). Since 2012, the government has opted for loans financing to improve the quality of infrastructure projects by taking advantage of the know-how and technical capacity of international companies and technical assistance from lending agencies. Analysis conducted on infrastructure development reveals that Timor-Leste has borrowed up to USD $400 million to finance infrastructure projects in 2017, but this has since increased to USD $708 million by 2021. However, with the signing of a USD $127 million loan from the Asian Development Bank (ADB) and USD $121 million from the World Bank in 2022 for water infrastructure, the loan figure is now close to USD $1 billion. Furthermore, Timor-Leste has completed its first PPP project, the Tibar Bay Port, where the government contributed about USD $129 million for its construction and continues to pursue this modality in other sectors including tourism and housing.

Infrastructure investment and economic diversification

In general, infrastructure contributes to the diversification of the economy in the following ways:

- Good infrastructure such as roads, bridges, ports, and telecommunications can lower the cost of doing business because it allows the transportation of goods and services in an easy and cheaper manner. This leads to lower prices for consumers and increased profits for businesses, which make it more attractive for businesses to invest in a country.

- Good infrastructure can attract foreign investment because foreign investors are more likely to invest in a country where they are able to operate efficiently. New investment can lead to the creation of new jobs and the development of new industries.

- Good infrastructure facilitates trade between countries. This leads to increased exports and imports activities and exposes a country to new markets and new products.

- Infrastructure creates jobs both directly and indirectly from the construction and maintenance of infrastructure projects. This can help reduce unemployment and poverty, contributing to a more stable environment for economic diversification.

Timor-Leste, so far, has made big infrastructure investment in the transportation sector (roads, airports and ports), and power sector. However, with the recent signing of USD $248 million in loans from ADB and the World Bank, meaningful infrastructure investment has been extended to the water sector. By adopting the front-loading approach, the government of Timor-Leste spends early on to build key infrastructure to prepare conditions necessary to promote economic activities, which can contribute to the diversification of economy. At the same time, Timor-Leste also diversifies its financing scheme for the key infrastructure to ensure value for the investment. Information presented in Table 4 shows the major infrastructure investment in different sectors in Timor-Leste.

Table 4: List of Large Projects Awarded to International Companies as of 2017

Source: da Cruz Cardoso, J (2019). Timor-Leste and China relations in the context of infrastructure development. In Leandro et. al., Challenges, Development and Promise of Timor-Leste (Table 2, p. 169).

Over the years, the government of Timor-Leste has discussed how the agriculture and tourism sectors are key for diversifying the economy and alternative options for moving away from the dependency on oil resources. However, out of the USD $3.6 billion expenditure in capital development within the ten-year period (2011–2020), only USD $8.2 million or 0.2% has been spent on the tourism sector and USD $48.2 million or 1.3% has been invested in the agriculture sector (see Table 5).

Table 5: Expenditure Trend for the Tourism and Agriculture Sectors, 2011–2020 (In USD Million)

|

Year |

Total |

Tourism Sector |

Agriculture Sector |

|

2011 |

554.975,9 |

1.029,5 |

2.183,5 |

|

2012 |

461.770,3 |

- |

5.027 |

|

2013 |

311.592,4 |

15,1 |

4.797,7 |

|

2014 |

371.359,4 |

1.631,2 |

12.274,1 |

|

2015 |

272.773,1 |

3.460,1 |

11.641,9 |

|

2016 |

581.384,6 |

1.659,2 |

2.496,3 |

|

2017 |

245.745,7 |

347,3 |

3.850,7 |

|

2018 |

336.098,0 |

14,1 |

3.510,6 |

|

2019 |

286.835,8 |

53,0 |

1.216,3 |

|

2020 |

154.894,7 |

- |

1.198,8 |

|

TOTAL |

3.577.429,9 |

8.209,5 |

48.196,7 |

Figure 2: Trend of expenditure in the tourism & agriculture sectors, 2011–2020

This spending trend exposes the insignificant infrastructure investment in the tourism and agriculture sectors, which contradicts the discourse of the prioritization of the sectors by the government. Meanwhile, investment for these sectors peaked between 2014 and 2015, and has since experienced a declining pattern – showing lack of financing commitment to invest and promote the sectors.

Moving forward on the diversification path

In many countries, results have shown that better infrastructure has contributed to economic diversification and growth because it helps connect countries with new markets and new opportunities in terms of the development of industries in the non-oil sectors, particularly the agriculture, tourism, and manufacturing sectors. For example, in CAREC (Central Asia Regional Economic Cooperation) countries, better infrastructure has improved connectivity, promoted regional trade, facilitated foreign direct investment (FDI) and fosters innovation and productivity. In China, massive development of infrastructure in the nineties has sustained high economic growth and increased competitiveness.

However, these countries also experience that infrastructure development has to go hand in hand with human capital development, good governance, access to financing and a strong private sector. For instance, while better infrastructure has been ensured, many CAREC countries face bottlenecks in economic diversification due to weak governance, limited financing options, and lack of a private sector-led enabling environment. Meanwhile, besides development of the physical infrastructure, economic policies enabling human capital formation and selection of right financing mechanisms has actually played a crucial part for growth to take place in China.

In terms of infrastructure, Timor-Leste is still on the right path because infrastructure investment has been mainly directed to the transportation and power sectors, leading to improved accessibility to electricity and connectivity (reduced travel time) within the country. Improved infrastructure in these sectors can really facilitate economic activities. However, considering the economy is driven by government expenditure, the country must expand its investment and significantly increase the proportion of the state budget to invest in the productive sectors while there is still enough money available in the Petroleum Fund and time to do so. Having fully-developed productive sectors will expand the non-oil revenue base and create jobs, contributing to a more resilient economy in the future.

Developing deeper infrastructure for a strong investment

Timor-Leste also must learn from the experience of other countries in the sense that development of the physical infrastructure must be supported by the development of human capital, good governance and strong private sectors. Similarly, Timor-Leste needs to look at the current policy debate on import substitution industrialization and export-led industrialization as strategies for economic diversification. These strategies have different objectives, where the first seeks to promote domestic industries to replace foreign-made goods for domestic goods, while the latter intends to speed up the industrialization process by opening domestic markets for foreign competition. Understanding these policies is vital for Timor-Leste to make an investment decision based on its strength.

There is no magic formula or quick fix for diversifying the economy of a country. However, Timor-Leste can really take a big step forward if it can make infrastructure investment decisions based on their overall contribution to the improvement of people’s well-being. While infrastructure investment in the productive sectors is important, there is also the need to improve non-infrastructure conditions to fully improve the sectors and maximize its contribution to the economy. For now, the government must allow a bigger share of the investment in the productive sectors, and it must continue to invest in education because it is the knowledge that transforms a tiny country into a giant economy.

__

Joao da Cruz Cardoso is an independent analyst of development in Timor-Leste.

This article is a personal opinion and does not represent the opinion of any institutions that the authors are affiliated with.

The views expressed by the authors are not necessarily those of Heinrich Böll Stiftung.

This article is a chapter from Neves, da Silva, Gomes, and Cardoso (2023), “Timor-Leste´s Economic Diversification: Challenges and the Way Forward”, Bangkok: Heinrich Böll Stiftung Southeast Asia Regional Office.